How a Medicare advisor helps you avoid costly mistakes

Wiki Article

Discover Exactly How a Medicare Agent Can Offer Assistance for Your Health Needs

Maneuvering via the intricacies of Medicare can be intimidating for numerous individuals. Comprehending the different components and choices offered is essential for making educated choices regarding health and wellness insurance coverage. A Medicare agent can play a crucial duty in this procedure. They offer insights tailored to individual demands. Selecting the appropriate agent is just as significant as recognizing the plans themselves. What variables should one consider when seeking guidance in this crucial location?Comprehending Medicare: The Essentials

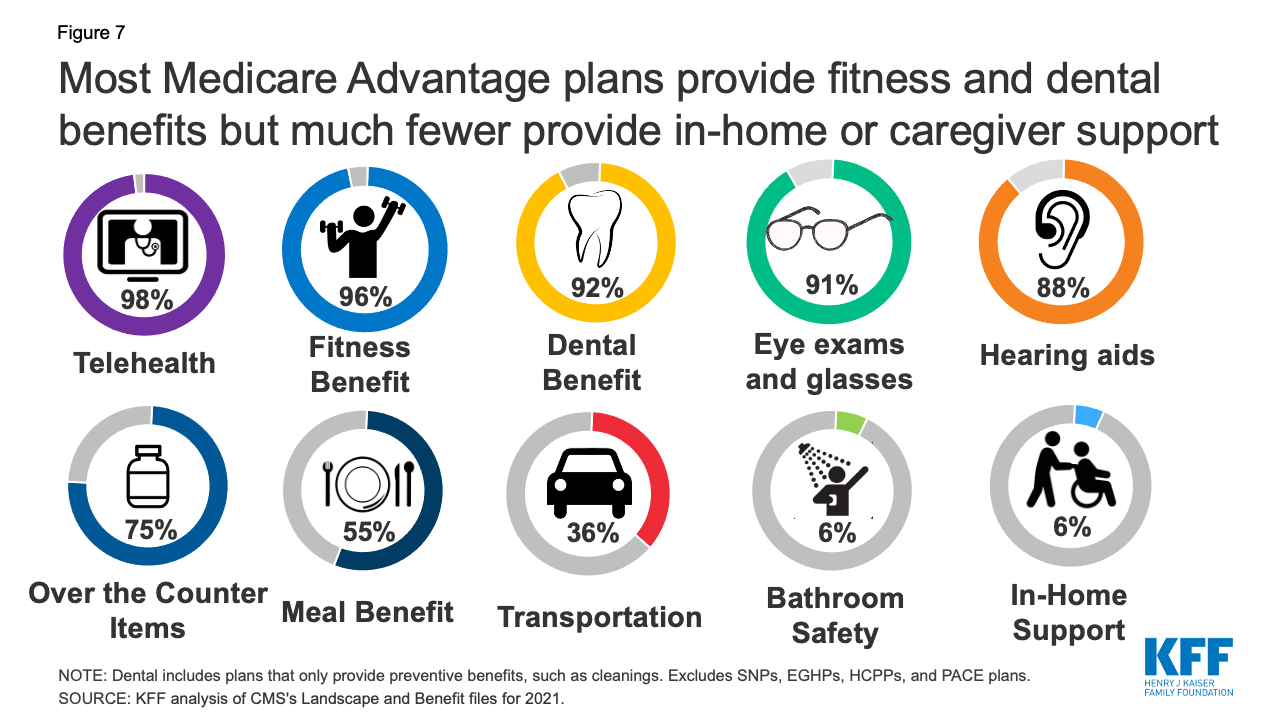

Additionally, people may pick to sign up in Medicare Benefit Program, which supply an alternate method to receive Medicare benefits through exclusive insurer. Part D provides prescription medicine coverage, permitting recipients to get necessary medicines at lowered prices. Recognizing these components is crucial for maneuvering the system successfully, making certain that individuals get the appropriate insurance coverage tailored to their health needs while managing prices efficiently.

The Duty of a Medicare Agent

Several people maneuvering the complexities of Medicare find valuable assistance with the proficiency of a Medicare agent. These experts function as well-informed overviews, assisting customers understand the numerous parts of Medicare, including Part A, Component B, Component C, and Component D. Their role includes evaluating private health and wellness demands, financial scenarios, and choices to advise suitable plans.Medicare representatives stay upgraded on the most up to date plan modifications, making sure that customers receive precise and prompt info. They assist in clarifying the registration process, target dates, and eligibility standards, decreasing the complication usually related to Medicare. Furthermore, agents simplify contrasts in between different strategies, highlighting insurance coverage options, costs, and prospective out-of-pocket expenditures.

Through tailored assessments, Medicare agents empower customers to make enlightened decisions regarding their medical care insurance coverage. Inevitably, their experience not just reduces anxiety but also enhances the general experience of passing through Medicare choices.

Advantages of Functioning With a Medicare Agent

Dealing with a Medicare agent uses considerable advantages for people managing their health care options. These professionals supply individualized insurance coverage recommendations tailored to particular demands, making certain clients make educated options. Additionally, their specialist support and ongoing support can streamline the typically intricate Medicare process.Personalized Coverage Options

Maneuvering the intricacies of Medicare can be frustrating for recipients, especially when it comes to picking the ideal protection options customized to private demands. A Medicare agent plays a crucial role in simplifying this procedure by reviewing each recipient's unique wellness demands, financial situation, and preferences. They can offer a selection of plans, including Medicare Benefit, Supplement plans, and Component D prescription drug insurance coverage. By utilizing their knowledge, recipients can recognize choices that not just satisfy their medical care requires however likewise fit within their spending plan. This tailored strategy warranties that people get one of the most suitable protection, optimizing their advantages while reducing out-of-pocket costs. Ultimately, working with a Medicare agent boosts the general experience of picking Medicare protection.Specialist Advice and Assistance

Maneuvering via Medicare choices can be frightening, but the assistance of a Medicare agent significantly eases this burden. These experts have extensive expertise of the numerous plans readily available, consisting of Medicare Benefit and Medigap policies. They give individualized assistance, aiding individuals understand their one-of-a-kind wellness needs and monetary circumstances. Agents also stay upgraded on changing guidelines and benefits, ensuring customers obtain one of the most current info. By analyzing various strategies, a Medicare agent can aid in identifying the most effective coverage alternatives, which can result in significant savings. Additionally, their expertise prolongs beyond enrollment, offering recurring support to browse claims and address any kind of issues that may occur. Medicare advisor. This partnership encourages beneficiaries to make enlightened choices concerning their medical carePersonalized Plan Comparisons

Tailored Coverage Options

Just how can individuals discover one of the most suitable Medicare protection for their one-of-a-kind demands? Tailored coverage alternatives are critical in making certain that each individual obtains the most ideal medical care strategy. Medicare agents play a vital function in this procedure by evaluating personal health conditions, medications, and favored health care service providers. They supply individualized strategy contrasts that highlight the distinctions amongst readily available protection options, consisting of Medicare Advantage and Component D strategies. This personalized strategy permits customers to recognize the advantages and limitations of each plan, making sure educated decision-making. By concentrating on special demands, Medicare representatives aid people navigate the intricacies of Medicare, ultimately bring about even more adequate and effective health care remedies. Customized protection options encourage beneficiaries to select strategies that align with their specific circumstances.Cost Analysis Approaches

Reviewing the expenses connected with Medicare intends calls for a critical technique that thinks about specific economic situations and healthcare needs. A Medicare agent plays page an essential function in this procedure by using individualized strategy comparisons. By examining premiums, deductibles, and out-of-pocket costs, agents assist clients recognize plans that line up with their spending plan and wellness needs. This customized assessment reaches evaluating possible prescription medication prices and service schedule within details geographic areas. Furthermore, representatives can highlight financial support choices for those who may qualify, making sure that clients make informed choices that maximize their healthcare spending. Ultimately, these expense analysis methods empower clients to choose the most suitable Medicare prepare for their special conditions.Plan Advantages Summary

Understanding the subtleties of Medicare strategy advantages is crucial for making informed healthcare choices. A Medicare agent plays an essential function in supplying personalized plan contrasts tailored to individual health and wellness needs. By assessing different choices, agents can highlight details advantages, such as protection for preventative services, prescription medicines, and specialized care. This tailored technique enables recipients to evaluate exactly how different plans align with their medical care demands and economic circumstances. Furthermore, agents can describe the intricacies of fringe benefits like vision and oral insurance coverage, which might not be consisted of in every plan. Ultimately, leveraging a Medicare agent's expertise assists individuals browse the intricacies of plan benefits, guaranteeing they pick the most suitable choice for their distinct scenarios.Ongoing Support and Assistance

Recurring support and assistance play a crucial function in the success of Medicare agents as they browse the complexities of the program. These experts are tasked with staying upgraded on plan modifications, strategy choices, and regulations that impact their clients. Continual education and training guarantee representatives have the current knowledge to supply precise guidance.Representatives typically establish long-term partnerships with their customers, providing individualized assistance tailored to specific health and wellness demands and choices. They aid in understanding benefits, filing cases, and dealing with issues that may occur throughout the registration process.

In addition, agents can act as a crucial resource for clients looking for info concerning extra insurance coverage or prescription medicine strategies. This continuous collaboration empowers customers to make educated decisions and adapt to their transforming health and wellness situations, eventually boosting their general experience with Medicare. Such assistance cultivates trust fund and fulfillment, adding considerably to the agent-client relationship.

Exactly how to Choose the Right Medicare Agent

Exactly how can one establish the very best Medicare agent to satisfy their demands? People need to seek representatives with proper accreditation and licenses, ensuring they are educated concerning Medicare programs. It is a good idea to inspect their experience, specifically in dealing with customers that have comparable health and wellness scenarios. Testimonials and reviews from previous customers can supply insight into a representative's integrity and solution quality.Next, prospective customers should review the agent's communication design; patient and clear interaction is necessary for recognizing intricate Medicare options. It is also crucial to ask whether the agent represents multiple insurance provider, as this widens the series of readily available strategies and enables tailored recommendations - Medicare advisor near me. Ultimately, individuals must really feel comfy asking inquiries and expressing worries, as an excellent agent will certainly prioritize their clients' needs and provide educated advice throughout the registration process

Frequently Asked Inquiries

Just how Do I Know if I Need a Medicare Agent?

Identifying the demand for a Medicare agent involves examining one's understanding of Medicare options, intricacy of medical care needs, and convenience with maneuvering through the system independently. Medicare agent. Seeking expert advice can simplify decision-making and improve insurance coverage selectionsAre Medicare Representatives Free to Make Use Of for Consumers?

Medicare agents normally do not bill consumers directly for their services - Medicare agents in. Instead, they are made up by insurance policy business for enlisting customers in strategies, making their support effectively cost-free for people seeking Medicare support and choicesCan I Adjustment My Medicare Plan Whenever?

Individuals can change their Medicare strategy throughout certain enrollment periods, such as the Yearly Registration Period or Unique Registration Periods. Outside these times, changes are typically not allowed, limiting flexibility in plan changes.What Certifications Should I Try to find in a Medicare Agent?

When choosing a Medicare agent, individuals must seek certifications such as proper licensing, substantial knowledge of Medicare strategies, solid communication skills, and favorable customer evaluations, ensuring they get customized and trusted help in exploring their choices.How Do Medicare Brokers Earn Money for Their Services?

Medicare agents typically make commissions from insurance coverage companies for every plan they offer - Medicare supplement agent near me. These commissions can differ based upon the sort of strategy and might consist of recurring settlements for revivals, incentivizing representatives to give recurring supportAdditionally, individuals may choose to enroll in Medicare Benefit Program, which use an alternate way to receive Medicare benefits via personal insurance coverage business. Several people maneuvering the intricacies of Medicare locate beneficial support with the expertise of a Medicare agent. Maneuvering via Medicare choices can be intimidating, but the assistance of a Medicare agent significantly reduces this burden. By concentrating on one-of-a-kind requirements, Medicare representatives assist individuals browse the complexities of Medicare, eventually leading to more effective and acceptable medical care services. Determining the need for a Medicare agent involves reviewing one's understanding of Medicare choices, intricacy of health care needs, and convenience with maneuvering with the system individually.

Report this wiki page